Escape financial stress & stop living paycheck-to-paycheck

The 4-Module System That Transforms Financially Stressed Women Into Confident Wealth Builders

Take ‘The Wealth Gym’ - your first step to financial security. Master healthy money habits, effective saving systems, and confidence you need to take control of your finances once and for all

(even if you live the paycheck-to-paycheck cycle right now).

Escape financial stress & stop living paycheck-to-paycheck

The 4-Module System That Transforms Financially Stressed Women Into Confident Wealth Builders

Take ‘The Wealth Gym’ - your first step to financial security. Master healthy money habits, effective saving systems, and confidence you need to take control of your finances once and for all

(even if you live the paycheck-to-paycheck cycle right now).

The Cruel Truth About Your Disappearing Paycheck

Every month, the same devastating cycle repeats itself...

You get paid and feel that familiar rush of possibility. Finally! This month will be different. This month you'll save.

But within days, your money starts disappearing. Not on luxuries or wild spending sprees—just on... life.

Bills. Groceries. That unexpected car repair. Your friend's birthday dinner.

The Cruel Truth About Your Disappearing Paycheck

Every month, the same devastating cycle repeats itself...

You get paid and feel that familiar rush of possibility. Finally! This month will be different. This month you'll save.

But within days, your money starts disappearing. Not on luxuries or wild spending sprees—just on... life.

Bills. Groceries. That unexpected car repair. Your friend's birthday dinner.

Before you know it, you're back to zero, wondering how someone as responsible as you can't seem to get ahead.

Here's what they don't tell you: It's not your fault.

The system is rigged against you. They teach us about geometry, biology, and the Roman Empire in school. But they don’t teach us how to manage our own money, let alone build lasting wealth...

You want to start saving for the future—to buy a house, start a family, maybe even start investing—but it feels more like a dream than a plan.

Before you know it, you're back to zero, wondering how someone as responsible as you can't seem to get ahead.

Here's what they don't tell you: It's not your fault.

The system is rigged against you. They teach us about geometry, biology, and the Roman Empire in school. But they don’t teach us how to manage our own money, let alone build lasting wealth...

You Need A PLAN To Build Wealth

Taking control of your finances is simple if you know where to start. But without a roadmap, you’ll easily get lost, slip up, or find yourself falling back into the same self-destructive money habits.

But what if you had a proven system that could teach you how to save, build financial confidence, and spend wisely instead?

Every day, I help women like you build the future of their dreams through smart and passive investing strategies. But first things first—before you start investing, you need to have your finances sorted.

That’s why I created this program: to help women like you take control of their finances, get out of debt, and start saving so that you can take the next step in your financial journey…

You Need A PLAN To Build Wealth

Taking control of your finances is simple if you know where to start. But without a roadmap, you’ll easily get lost, slip up, or find yourself falling back into the same self-destructive money habits.

But what if you had a proven system that could teach you how to save, build financial confidence, and spend wisely instead?

Every day, I help women like you build the future of their dreams through smart and passive investing strategies. But first things first—before you start investing, you need to have your finances sorted.

That’s why I created this program: to help women like you take control of their finances, get out of debt, and start saving so that you can take the next step in your financial journey…

YOUR PERSONAL GUIDE TO MASTERING YOUR FINANCES

I mastered my finances the hard way, so you don’t have to.

Hi, I’m Francesca.

I went to University on a scholarship. My parents were having financial difficulty, so they could only send me small, carefully measured amounts to cover my expenses.

Compared to my peers, I felt like I was struggling, but it was a great life lesson. Because it forced me to learn how to budget properly.

I would go grocery shopping and add up the price of each item as I put it in the cart to avoid being embarrassed by not having enough money when I arrived at the checkout.

YOUR PERSONAL GUIDE TO MASTERING YOUR FINANCES

I mastered my finances the hard way, so you don’t have to.

Hi, I’m Francesca.

I went to University on a scholarship. My parents were having financial difficulty, so they could only send me small, carefully measured amounts to cover my expenses.

Compared to my peers, I felt like I was struggling, but it was a great life lesson. Because it forced me to learn how to budget properly.

I would go grocery shopping and add up the price of each item as I put it in the cart to avoid being embarrassed by not having enough money when I arrived at the checkout.

Later, when I got a great job, those same budgeting skills helped me to start saving at a young age and build the capital that I would eventually invest.

There is no magic to mastering your finances. I mastered mine by necessity, and I can help you master yours by choice.

This program will help you build the confidence and money skills you’ll need to eventually become financially stable today and a profitable investor tomorrow—maybe much sooner than you think.

There’s no better time than now to build your wealth—so I invite you to get started today!

Later, when I got a great job, those same budgeting skills helped me to start saving at a young age and build the capital that I would eventually invest.

There is no magic to mastering your finances. I mastered mine by necessity, and I can help you master yours by choice.

This program will help you build the confidence and money skills you’ll need to eventually become financially stable today and a profitable investor tomorrow—maybe much sooner than you think.

There’s no better time than now to build your wealth—so I invite you to get started today!

Finally Take Control Of Your Money!

INTRODUCING

The Wealth Gym

The program that helps you sculpt healthy money habits, effective saving systems, and the mindset of a financial powerhouse.

INTRODUCING

The Wealth Gym

The program that helps you sculpt healthy money habits, effective saving systems, and the mindset of a financial powerhouse.

Imagine opening your bank app and seeing $10,000 in your Savings Account...

Picture this:

- Your car breaks down, and instead of panic, you feel calm. You have the money. No credit cards, no borrowing from family, no sleepless nights.

- Imagine checking your bank balance and smiling instead of wincing.

- Imagine your friends asking for financial advice because they see how confident and in control you've become.

- Imagine looking at your retirement account and knowing—really knowing—that you're going to be okay.

- What would it feel like to never again whisper "declined" at the checkout? To book that vacation without guilt? To sleep peacefully knowing you're prepared for whatever life throws at you?

- This isn't a fantasy. It's the reality for hundreds of women who've completed The Wealth Gym...

Stop living paycheck-to-paycheck and transform your financial stress into confidence, calm and habits that build wealth

Yes! I'm ready to stop financial stressImagine opening your bank app and seeing $10,000 in your Savings Account...

Picture this:

- Your car breaks down, and instead of panic, you feel calm. You have the money. No credit cards, no borrowing from family, no sleepless nights.

- Imagine checking your bank balance and smiling instead of wincing.

- Imagine your friends asking for financial advice because they see how confident and in control you've become.

- Imagine looking at your retirement account and knowing—really knowing—that you're going to be okay.

- What would it feel like to never again whisper "declined" at the checkout? To book that vacation without guilt? To sleep peacefully knowing you're prepared for whatever life throws at you?

- This isn't a fantasy. It's the reality for hundreds of women who've completed The Wealth Gym...

Stop living paycheck-to-paycheck and transform your financial stress into confidence, calm and habits that build wealth

Yes! I'm ready to stop financial stressStop Struggling Month to Month & Strengthen Your Finances With The Wealth Gym

Stop Struggling Month to Month & Strengthen Your Finances With The Wealth Gym

Wealth Gym trains you with the knowledge, tools, and support you need to transform your financial future, starting today.

Gain confidence, start saving, and lay the groundwork for successful investing.

Wealth Gym trains you with the knowledge, tools, and support you need to transform your financial future, starting today.

Gain confidence, start saving, and lay the groundwork for successful investing.

Course Highlights:

- Weekly Money Rituals: Develop a fun weekly money ritual that helps heal your mindset, inspires clarity, and gives you power over your finances.

- Money-Saving Systems: Learn how to set clear financial goals, budget effectively, and spend in line with your values without giving up everything you love.

- Debt Management Strategies: Discover proven strategies to pay down debt, reduce interest, and progress toward financial freedom.

- Mindset Mastery: Acquire techniques to develop a positive and proactive financial mindset, which will empower you to take control of your money

- Home Buying Basics: Learn the essentials of buying a home, from saving for a down payment to understanding mortgages and the real costs of ownership

- Increasing Your Income: Explore strategies to increase your income, including negotiation tips, side hustles, and introductory investment principles

- Retirement Planning & Pensions: Gain clarity on retirement basics, including pension options, the 4% rule, and the steps to build a secure retirement

- Financial Empowerment: Build the confidence and skills to manage your money effectively. Learn to save, reduce debt, and take the first steps toward investing!

Course Highlights:

- Weekly Money Rituals: Develop a fun weekly money ritual that helps heal your mindset, inspires clarity, and gives you power over your finances.

- Money-Saving Systems: Learn how to set clear financial goals, budget effectively, and spend in line with your values without giving up everything you love.

- Debt Management Strategies: Discover proven strategies to pay down debt, reduce interest, and progress toward financial freedom.

- Mindset Mastery: Acquire techniques to develop a positive and proactive financial mindset, which will empower you to take control of your money

- Home Buying Basics: Learn the essentials of buying a home, from saving for a down payment to understanding mortgages and the real costs of ownership

- Increasing Your Income: Explore strategies to increase your income, including negotiation tips, side hustles, and introductory investment principles

- Retirement Planning & Pensions: Gain clarity on retirement basics, including pension options, the 4% rule, and the steps to build a secure retirement

- Financial Empowerment: Build the confidence and skills to manage your money effectively. Learn to save, reduce debt, and take the first steps toward investing!

You Will Learn How To:

- Assess Your Financial Condition: Utilize our tools and resources to get a clear view of your financial health, including budgeting basics and emergency fund planning

- Eliminate Limiting Beliefs: Your beliefs about money are as important as your budget. I’ll show you how to embrace wealth and build a loving relationship with money

- Save Money Reliably: Implement easy, repeatable savings methods to fund your emergency account and prepare for future investments

- Build a Personalized Financial Plan: You’ll learn to create a comprehensive financial plan that is 100% tailored to your goals, income, and lifestyle

- Forecast Your Monthly Budget: Plan your expenses and income with precision

- Accurately Track Your Spending: Monitor your forecasted and actual spending to stay on track

- Monitor And Eliminate Debt: Effectively pay down debts and reduce the burden of interest through actionable debt management techniques

- Set & Achieve Financial Goals: Learn to set achievable financial goals that inspire and motivate, including retirement planning with strategies like the 4% Rule and Bucket Method

- Plan A Secure Retirement: Discover the foundational principles of retirement planning to help you work toward financial independence with confidence

- And Much More!

Are You Ready To Stop Struggling And Start Saving?

Transform my Money Life starting todayYou Will Learn How To:

- Assess Your Financial Condition: Utilize our tools and resources to get a clear view of your financial health, including budgeting basics and emergency fund planning

- Eliminate Limiting Beliefs: Your beliefs about money are as important as your budget. I’ll show you how to embrace wealth and build a loving relationship with money

- Save Money Reliably: Implement easy, repeatable savings methods to fund your emergency account and prepare for future investments

- Build a Personalized Financial Plan: You’ll learn to create a comprehensive financial plan that is 100% tailored to your goals, income, and lifestyle

- Forecast Your Monthly Budget: Plan your expenses and income with precision

- Accurately Track Your Spending: Monitor your forecasted and actual spending to stay on track

- Monitor And Eliminate Debt: Effectively pay down debts and reduce the burden of interest through actionable debt management techniques

- Set & Achieve Financial Goals: Learn to set achievable financial goals that inspire and motivate, including retirement planning with strategies like the 4% Rule and Bucket Method

- Plan A Secure Retirement: Discover the foundational principles of retirement planning to help you work toward financial independence with confidence

- And Much More!

Are You Ready To Stop Struggling And Start Saving?

Yes, I want to join The Wealth Gym

PLUS, FREE BONUS:

My Financial Independence All-In-One Planner

(A €100 Value! - FREE)

Grab my comprehensive financial planner that will walk you through the key items you need to launch your journey to financial security and independence

- Money Date

- Monthly Setup and Financial Goals

- Net Worth Checkup

- 50/30/20 Profile

- Emergency Fund Calculator

- Transactions

- Spending Tracker - Forecast and Actuals

- Budget Summary

- Retirement planning Part 1 & 2

PLUS, FREE BONUS:

My Financial Independence All-In-One Planner

(A €100 Value! - FREE)

Grab my comprehensive financial planner that will walk you through the key items you need to launch your journey to financial security and independence

- Money Date

- Monthly Setup and Financial Goals

- Net Worth Checkup

- 50/30/20 Profile

- Emergency Fund Calculator

- Transactions

- Spending Tracker - Forecast and Actuals

- Budget Summary

- Retirement planning Part 1 & 2

By the end of this course, you will:

- Clearly understand your financial health and goals: Conduct an in-depth assessment of your finances and set meaningful, achievable financial goals

- Develop a sustainable and effective saving strategy: Build emergency savings, set up automatic saving systems, and learn budgeting techniques that align with your lifestyle

- Create a robust financial plan to confidently manage your money: Design a personalized plan that includes income tracking, debt management, and a strategy for future investments

- Gain the skills and mindset to create a brighter future for yourself and your family: Build financial confidence, embrace a positive money mindset, and prepare for major goals like home ownership, retirement, and even income growth opportunities

- Understand the essentials of home buying, retirement planning, and increasing your income: Gain clarity on pensions, mortgages, and strategies for raising your income through side hustles, salary negotiation, and foundational investment steps

Start Building Wealth Today!

Join the Wealth GymBy the end of this course, you will:

- Clearly understand your financial health and goals: Conduct an in-depth assessment of your finances and set meaningful, achievable financial goals

- Develop a sustainable and effective saving strategy: Build emergency savings, set up automatic saving systems, and learn budgeting techniques that align with your lifestyle

- Create a robust financial plan to confidently manage your money: Design a personalized plan that includes income tracking, debt management, and a strategy for future investments

- Gain the skills and mindset to create a brighter future for yourself and your family: Build financial confidence, embrace a positive money mindset, and prepare for major goals like home ownership, retirement, and even income growth opportunities

- Understand the essentials of home buying, retirement planning, and increasing your income: Gain clarity on pensions, mortgages, and strategies for raising your income through side hustles, salary negotiation, and foundational investment steps

Start Building Wealth Today!

Join the Wealth GymFoundational Lessons To Help Any Woman Take Control Of Her Finances And Finally Feel Confident With Money!

MODULE 1:

🧠 Building a Wealth Mindset

Why Money Mindset Matters

Learn to ❤️ your money! Overcome limiting beliefs, conquer fear, and stop feeling guilty about factors that aren’t your fault to reset your relationship with money!

- Spotlight: Discover how mindset shifts can multiply wealth—no spreadsheets required.

- Get Clarity: Personal Money Mindset Quiz + journaling exercises to decode and design your new money mindset.

- Tools & Resources: Receive exclusive “Money Mindset Blueprint” prompts and actionable steps to set the foundation for sustainable wealth.

MODULE 2:

🩺 Mastering Your Finances

Your Financial Health Check

Module 2 is a complete, practical guide to taking charge of your money today, whether you’re battling debt or building savings. Cover every base, from your financial snapshot to strategic debt reduction, credit boosting, and step-by-step budgeting techniques.

- Transformative Learning: Visualize your entire financial health with step-by-step budgeting guides, plus strategies for building and protecting your savings.

- Exclusive Tools: Financial Independence Planner loaded with tabs for goal setting, budget tracking, net worth checking, emergency fund calculators, and more!

- Extra Edge: Discover budgeting frameworks like the 50/30/20 Rule and the 3-Account Approach, plus in-depth comparisons of debt repayment strategies to fit your life.

MODULE 3:

🎯 Planning for Freedom

Preparing for Financial Independence and Retirement

Dive into this module to create your own roadmap for financial freedom and retirement, including essential steps for building long-term wealth. Learn how much you truly need, powerful investment strategies, and the art of setting life-altering financial goals.

- Financial Freedom Calculation: Determine the true cost of freedom with goal calculators, and know exactly what it takes to retire early or live on your terms.

- Advanced Strategies: Get introduced to the 4% Rule, time-tested to help you build wealth confidently.

- Personalized Planner: Financial Independence Planner with retirement-specific tabs that give you the tools to start creating your financial future immediately.

MODULE 4:

📈 The Essentials of Home Ownership

Buying a Home

In this powerful module, get a clear, practical look at home ownership essentials. From saving for a down payment to learning the ins and outs of mortgages, every lesson is packed with insights to help you make smart choices.

- Buy or Rent? Discover whether buying is right for you with our tools, designed to make one of the biggest financial decisions in your life easier.

- Comprehensive Mortgage Guide: Understand mortgage types, requirements, and what lenders look for, so you can confidently navigate the buying process.

- Smart Planning Tools: Calculate your savings goal and plan for the “hidden” costs of home ownership, ensuring you’re prepared before stepping into the market.

Foundational Lessons To Help Any Woman Take Control Of Her Finances And Finally Feel Confident With Money!

MODULE 1:

🧠 Building a Wealth Mindset

Why Money Mindset Matters

Learn to ❤️ your money! Overcome limiting beliefs, conquer fear, and stop feeling guilty about factors that aren’t your fault to reset your relationship with money!

- Spotlight: Discover how mindset shifts can multiply wealth—no spreadsheets required.

- Get Clarity: Personal Money Mindset Quiz + journaling exercises to decode and design your new money mindset.

- Tools & Resources: Receive exclusive “Money Mindset Blueprint” prompts and actionable steps to set the foundation for sustainable wealth.

MODULE 2:

🩺 Mastering Your Finances

Your Financial Health Check

Module 2 is a complete, practical guide to taking charge of your money today, whether you’re battling debt or building savings. Cover every base, from your financial snapshot to strategic debt reduction, credit boosting, and step-by-step budgeting techniques.

- Transformative Learning: Visualize your entire financial health with step-by-step budgeting guides, plus strategies for building and protecting your savings.

- Exclusive Tools: Financial Independence Planner loaded with tabs for goal setting, budget tracking, net worth checking, emergency fund calculators, and more!

- Extra Edge: Discover budgeting frameworks like the 50/30/20 Rule and the 3-Account Approach, plus in-depth comparisons of debt repayment strategies to fit your life.

MODULE 3:

🎯 Planning for Freedom

Preparing for Financial Independence and Retirement

Dive into this module to create your own roadmap for financial freedom and retirement, including essential steps for building long-term wealth. Learn how much you truly need, powerful investment strategies, and the art of setting life-altering financial goals.

- Financial Freedom Calculation: Determine the true cost of freedom with goal calculators, and know exactly what it takes to retire early or live on your terms.

- Advanced Strategies: Get introduced to the 4% Rule, time-tested to help you build wealth confidently.

- Personalized Planner: Financial Independence Planner with retirement-specific tabs that give you the tools to start creating your financial future immediately.

MODULE 4:

📈 The Essentials of Home Ownership

Buying a Home

In this powerful module, get a clear, practical look at home ownership essentials. From saving for a down payment to learning the ins and outs of mortgages, every lesson is packed with insights to help you make smart choices.

- Buy or Rent? Discover whether buying is right for you with our tools, designed to make one of the biggest financial decisions in your life easier.

- Comprehensive Mortgage Guide: Understand mortgage types, requirements, and what lenders look for, so you can confidently navigate the buying process.

- Smart Planning Tools: Calculate your savings goal and plan for the “hidden” costs of home ownership, ensuring you’re prepared before stepping into the market.

Learn At Your Own Pace

On-demand access is ideal for professional women, students, and busy moms

Easy-To-Grasp Video Lessons

Quick video lessons simplify financial topics to make them accessible to everyone

By Women, For Women

Tackle the unique challenges that women face in creating financial freedom

Be Prepared for The Unexpected

Get advice to prepare you for unexpected life events such as divorce, etc.

Learn At Your Own Pace

On-demand access is ideal for professional women, students, and busy moms

Easy-To-Grasp Video Lessons

Quick video lessons simplify financial topics to make them accessible to everyone

By Women, For Women

Tackle the unique challenges that women face in creating financial freedom

Be Prepared for The Unexpected

Get advice to prepare you for unexpected life events such as divorce, etc.

Plus another Bonus…an extra module on how to increase your income!

MODULE 5:

📈 Growing Your Income and Wealth

Take control of your earning potential and build wealth with purpose

Module 5 provides actionable steps to increase your income through smart strategies, tailored to fit your skills and lifestyle.

You’ll learn to negotiate pay raises confidently, explore side hustles that fit your schedule, and understand beginner investing basics to help you grow your money over time.

With practical lessons that debunk common investing myths, explain why investing matters, and demystify essential concepts, this module empowers you to start building a future of financial independence.

Plus another Bonus…an extra module on how to increase your income!

MODULE 5:

📈 Growing Your Income and Wealth

Take control of your earning potential and build wealth with purpose

Module 5 provides actionable steps to increase your income through smart strategies, tailored to fit your skills and lifestyle.

You’ll learn to negotiate pay raises confidently, explore side hustles that fit your schedule, and understand beginner investing basics to help you grow your money over time.

With practical lessons that debunk common investing myths, explain why investing matters, and demystify essential concepts, this module empowers you to start building a future of financial independence.

Here Is EVERYTHING You’ll Get When You Enroll In The Wealth Gym Today:

Here Is EVERYTHING You’ll Get When You Enroll In The Wealth Gym Today:

- 4 On-Demand Learning Modules, Including 40 Easy-To-Grasp Video Lessons (€800 Value) and quizzes

- 1-Year Access to all course materials and updates

- Easy-To-Use Workbooks and Tools such as Money journal prompts, Build your Money Mindset, Rent vs Buy calculator and more (€200 Value)

- BONUS: Financial Independence All-In-One Planner (€100 Value) + a full Module on “How to Growing Your Income and Wealth” (€200 Value)

- Email support!

- The Knowledge, Confidence, & Tools You’ll Need To Create A Better Future For Yourself And Your Family (Priceless!)

- 4 On-Demand Learning Modules, Including 40 Easy-To-Grasp Video Lessons (€800 Value) and quizzes

- 1-Year Access to all course materials and updates

- Easy-To-Use Workbooks and Tools such as Money journal prompts, Build your Money Mindset, Rent vs Buy calculator and more (€200 Value)

- BONUS: Financial Independence All-In-One Planner (€100 Value) + a full Module on “How to Growing Your Income and Wealth” (€200 Value)

- Email support!

- The Knowledge, Confidence, & Tools You’ll Need To Create A Better Future For Yourself And Your Family (Priceless!)

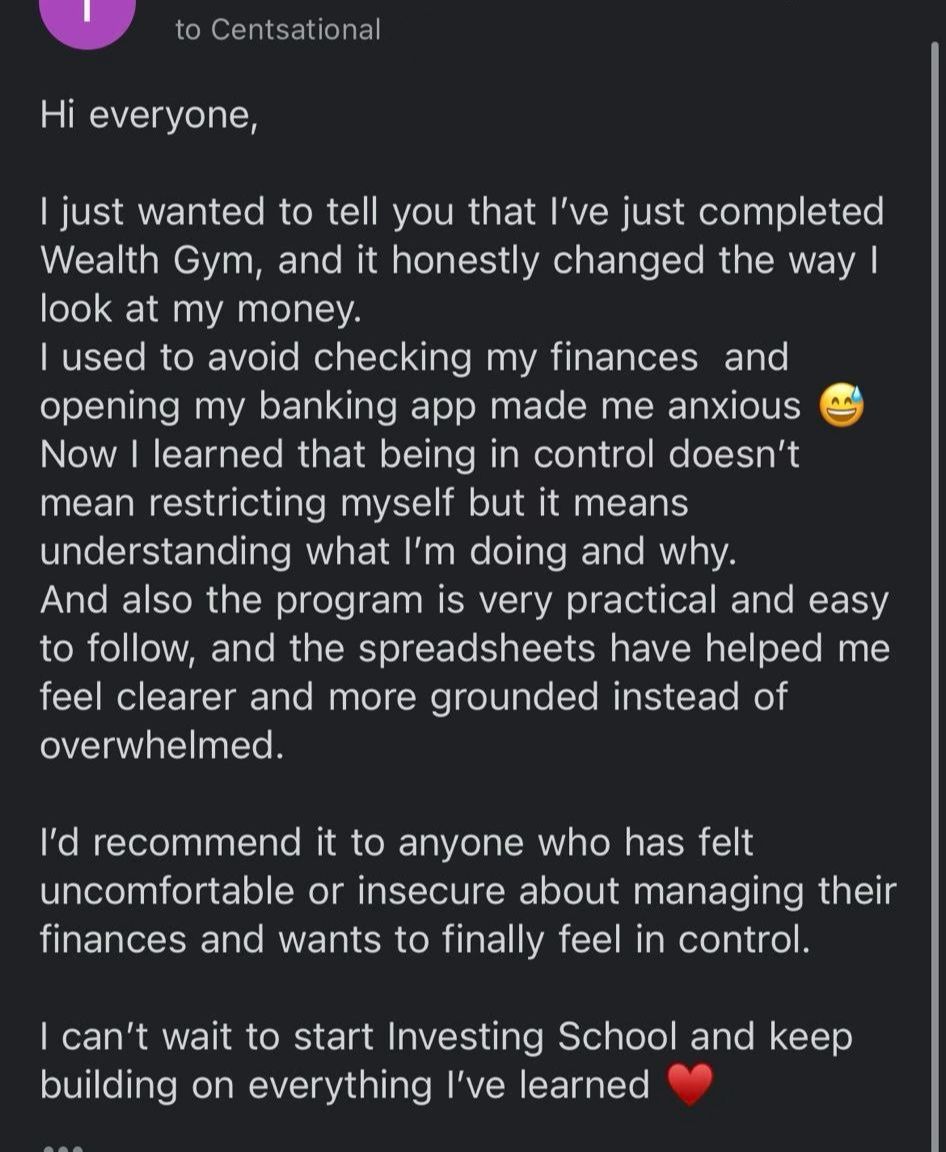

More Words Of Praise From Wealth Gym Graduates

More Words Of Praise From Wealth Gym Graduates

The Wealth Gym turned my financial life around. I was living paycheck to paycheck with no savings in sight. Now, I’ve built an emergency fund and even started planning for retirement. The mindset shifts and practical tools Francesca provides are life-changing.

Sofia L., Germany

The Wealth Gym turned my financial life around. I was living paycheck to paycheck with no savings in sight. Now, I’ve built an emergency fund and even started planning for retirement. The mindset shifts and practical tools Francesca provides are life-changing.

Sofia L., Germany

Before The Wealth Gym, I was constantly stressed about money. I thought managing finances was beyond me, but this course made everything simple and actionable. I paid off £2,000 in credit card debt and started saving for the first time in years. This course is a must for anyone who feels lost with their money.

Laura M., UK

Before The Wealth Gym, I was constantly stressed about money. I thought managing finances was beyond me, but this course made everything simple and actionable. I paid off £2,000 in credit card debt and started saving for the first time in years. This course is a must for anyone who feels lost with their money.

Laura M., UK

This entire system could easily be sold for €1,300+, but because I’m committed to helping women like you build financial freedom, you can get started today for just €397!

Save Over €1000!

TOTAL VALUE: €1,300+

Your Price Today: €497

€397

Join Wealth Gym

This entire system could easily be sold for €1,300+, but because I’m committed to helping women like you build financial freedom, you can get started today for just €397!

Save Over €1000!

TOTAL VALUE: €1,300+

Your Price Today: €397

Enroll Now!Here's What Happens If You Do Nothing...

I have to be honest with you about something uncomfortable:

If you close this page and do nothing, your financial situation won't magically improve.

Next month, you'll have the same money stress. Next year, you'll still be living paycheck to paycheck. In five years, you'll be further behind because you'll have missed five years of potential wealth building.

The women who transform their finances are the ones who make a decision and take action TODAY.

The choice is yours: You can continue the struggle, or you can invest in yourself and change everything.

But please, don't let fear of spending €397 keep you trapped in a cycle that's already costing you thousands.

If you want the next few months to feel calmer and more spacious, this is the moment to make that shift.

I WANT TO JOIN THE WEALTH GYMHere's What Happens If You Do Nothing...

I have to be honest with you about something uncomfortable:

If you close this page and do nothing, your financial situation won't magically improve.

Next month, you'll have the same money stress. Next year, you'll still be living paycheck to paycheck. In five years, you'll be further behind because you'll have missed five years of potential wealth building.

The women who transform their finances are the ones who make a decision and take action TODAY.

The choice is yours: You can continue the struggle, or you can invest in yourself and change everything.

But please, don't let fear of spending €397 keep you trapped in a cycle that's already costing you thousands.

If you want the next few months to feel calmer and more spacious, this is the moment to make that shift.

I WANT TO JOIN THE WEALTH GYMFrequently Asked Questions

Frequently Asked Questions

How long do I need to complete the course?

The modules in The Wealth Gym are released weekly to give you time to process and implement what you learn each week. There are 4+1 modules, so it will take you 4-5 weeks if you study and implement them as soon as your lessons are available.

How long do I have access to the course materials?

You’ll have access to all the learning modules for one year. The workbooks, templates, tools, and spreadsheets are yours to keep—so you’ll have them forever!

Will The Wealth Gym teach me to invest?

No, the course is focused more on financial management, like budgeting, saving, and paying down debt. Once you’ve filled your emergency fund and set aside a bit of money (it could be as little as €50), I’d recommend you take my Investing School course to learn step-by-step how to make your first investments. However, if you know you want to start investing in the next 6-12 months, you can save €298 by signing up for Investing School Gold program to get The Wealth Gym as a free gift!

Can I take this course if I don’t know anything about finances?

Yes! This course is created for complete beginners and people with some financial knowledge who lack discipline and structure in their personal finances. No matter your starting point, I’ll explain everything you need to know in plain language, simplifying complex topics and avoiding unnecessary jargon. If you’re a beginner, you’ve come to the right place!

What if I'm in debt? Will this still work for me?

Yes, yes, yes. Wealth Gym isn’t just “okay” if you’re in debt, it’s actually designed to help you navigate that. In Module 2, we walk you through exactly how to manage your finances, and that includes a whole lesson on debt — how to handle it without shame or overwhelm. No judgment. No impossible rules. Just clear steps to take back control. You don’t need to “fix your situation” before you start. You start and that’s what helps you fix it.

I've tried budgeting before and failed. How is this different?

Girl, welcome to the club. Almost every woman who joins Wealth Gym says the same thing: “I’ve tried budgeting apps or books… and gave up.” That’s because most budgeting advice is rigid, unrealistic, and written by someone who’s never had to decide between buying groceries or paying the electricity bill.

This is different. We start with your mindset — not your spreadsheet. We help you understand how you relate to money, what’s been holding you back, and how to build a system that actually fits your life (not some fantasy version of it).

This isn’t about being perfect. It’s about being honest — and supported.

What if I don’t have time to complete the modules?

Then you’re exactly who we built this for.

Each lesson is short and snackable (think 10–15 mins tops), and you can follow along from your phone while commuting, cooking, or hiding in the bathroom for five minutes of peace. You don’t need to “finish everything” to see a shift.

Even the first module can change how you think about money — and that ripple effect is huge. This isn’t a pressure cooker. It’s a resource. You dip in when you can, and it’s there when you’re ready.

Is there a money-back guarantee?

Nope — because Wealth Gym isn’t Netflix. You don’t join to “see if you feel like it.” You join, you roll up your sleeves, and you get results. No refund = no excuses. And honestly? That’s the secret to actually doing the work and changing your money game for good.